How Marketing Impacts Valuation in M&A & Why Marketing Due Diligence Is Critical

In mergers and acquisitions (M&A), marketing is often the missing piece of the buyers puzzle, (and sellers, more on that later). While financials, legal risks, and operational performance are deeply examined, marketing, the very thing that drives revenue and customer growth, is often left either completely ignored or glossed over.

At FIARRA, we provide investor-level M&A marketing due diligence through our comprehensive Marketing Deep-Dive audits, giving buyers and sellers a true picture of marketing performance, scalability, and risk.

Why? Because if you were purchasing a business, you should be fully aware of any potential post-sale investment required. Just like buying a car, you don’t want to purchase it only to find it needs a new engine, four new tyres and a full service. We go beneath the surface using industry leading software to really understand the marketing health of your investment.

“A deep-dive helps investors and business buyers understand what work would be required to maximise their ROI both in the long and short term. For sellers, it's a great way to get their business ready for sale, maximising its potential value and attractiveness.”

Darren Dunn, FIARRA

Why M&A Marketing Due Diligence Shouldn’t Be Overlooked.

Marketing isn’t just a cost on the P&L — it’s a value driver that can strengthen or undermine an entire deal. During an acquisition, marketing directly affects:

- Cost per lead (CPL)

-

Customer acquisition cost (CAC)

-

Lifetime customer value (LTV)

-

Revenue attribution

-

Brand equity

-

Pipeline health and forecast accuracy

-

Growth scalability

Without proper M&A marketing due diligence, these critical drivers go unchecked, exposing acquirers to hidden risks and sellers to undervaluation.

The Risks of Skipping Marketing Due Diligence.

Buyers often inherit marketing operations that look fine on the surface but fall apart post-close:

-

Overdependence on a single ad platform (e.g. Google or Meta) with no diversification

-

Poorly tracked lead sources, making ROI unclear

-

Brand equity tied too closely to the founder’s personal presence (Often referred to as key person dependant).

-

Inconsistent or misleading marketing reports from agencies

-

A CRM full of inactive, cold, or duplicate leads

-

Underperforming email sequences or abandoned funnels

None of these problems are immediately visible in financial due diligence, but they can directly affect post-acquisition performance.

FIARRA’s Deep-Dive: Built for M&A Marketing Due Diligence.

Our Deep-Dive audit is tailored specifically for M&A scenarios. We audit the entire marketing ecosystem to reveal both hidden risk and unrealised opportunity.

Here’s just a taste of what our M&A-focused marketing audit covers:

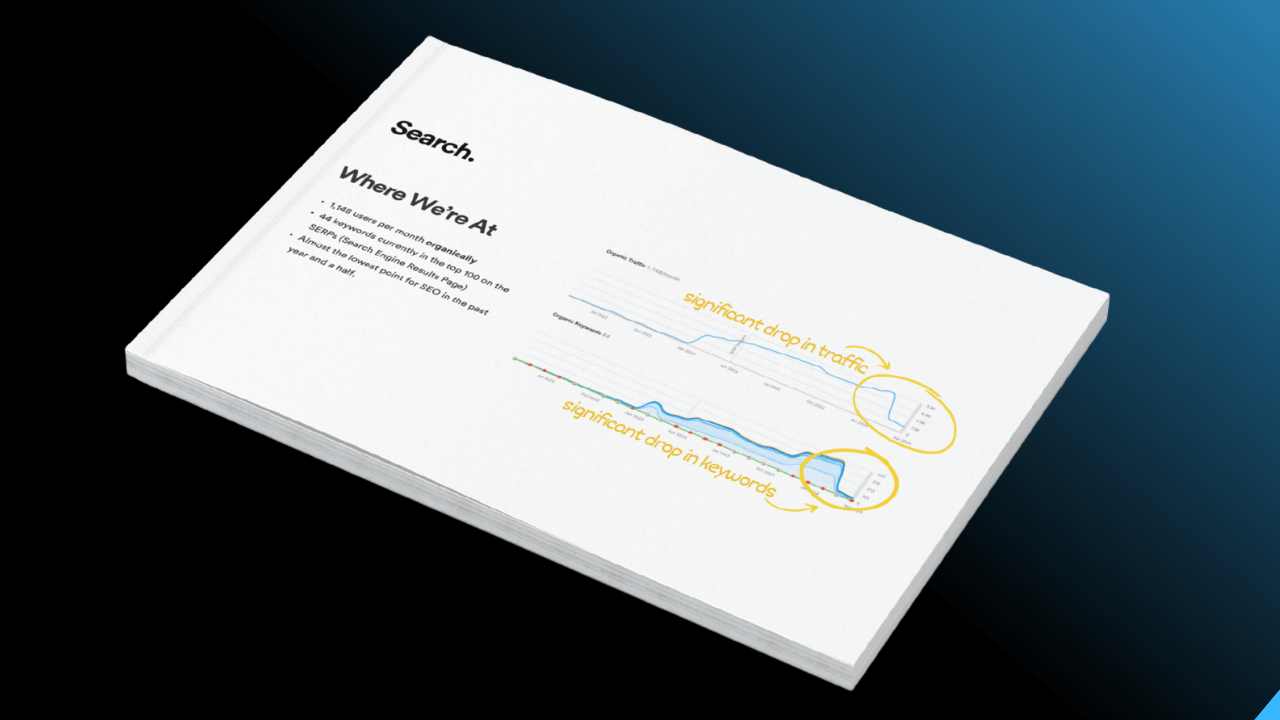

Website & SEO Performance

Organic & paid traffic reports.

Keyword rankings & backlink health

UI/UX feedback (design)

- Potential sandboxing/blacklisting

- Legal compliance risks

Paid Ads

Campaign efficiency

Spend attribution

Targeting strategy

Platform risk & reliance

Brand & Creative Audit

Consistency across platforms

Strength of visual identity

Scalability of messaging without the founder/key person dependance.

Social Media Performance

Real vs. vanity metrics

Audience insights

Strategic positioning

- Underutilised assets

- Cloned/locked assets

Competitor Benchmarking

Market positioning

Missed opportunities

Areas of differentiation or saturation

Plus more a shed load more!

A Real-Life Example.

In a recent deep-dive, we discovered a business which was doing well, but could be doing a lot better. A deep-dive into their meta campaigns showed us that they were spending over £300 per month on meta campaigns…for the wrong city.

Why would this be valuable to a potential buyer?

-

This is money already calculated in the P&L.

-

A simple diversion of funds and boom, you’ve just created an additional £3,600 for your marketing budget without paying any extra.

-

The diversion of funds could have an immediate positive impact on revenue.

Should this business be for sale, this deep-dive would showcase “low hanging fruit” as some would call it. The new owner could divert these funds into better revenue generating campaigns.

Whether You’re Buying or Selling, Marketing Due Diligence Pays Off.

If you’re:

-

An acquirer looking to protect your investment

-

A seller wanting to increase your business valuation

-

A broker or advisor needing marketing visibility in the deal room

…then M&A marketing due diligence is non-negotiable.

FIARRA’s Deep-Dive gives you clarity, leverage, and confidence. Not just in the numbers, but in the growth engine behind them.